Best Multibagger Stocks for 2025: Top 5 Sectors to Watch (Tech & Defence)

Best multibagger stocks for 2025 are not about tips or hype—it’s about identifying strong sectors early. With India entering a capex-led growth cycle, defence, technology, and manufacturing sectors are showing early multibagger signals.

If you’re a long-term investor looking for wealth-creating opportunities, this guide explains which sectors can deliver multibagger returns in 2025 and why—with real market logic, not social media noise.

🔹 Introduction (Why 2025 Is Different)

The best multibagger stocks for 2025 will come from sectoral trends, not penny stocks. In my market experience, real multibaggers emerge when policy + earnings + demand cycle align.

2025 is crucial because:

- Government capex is rising

- Private investment is picking up

- India is becoming a global manufacturing hub

This article helps you identify top 5 sectors where future multibagger stocks are likely to emerge.

📌 Table of Contents

- Current Indian Market Overview

- Why Sector-Based Investing Creates Multibaggers

- Top 5 Multibagger Sectors for 2025

- How to Identify a Multibagger Stock

- Risk Management & Common Mistakes

- FAQs

- Final Conclusion & CTA

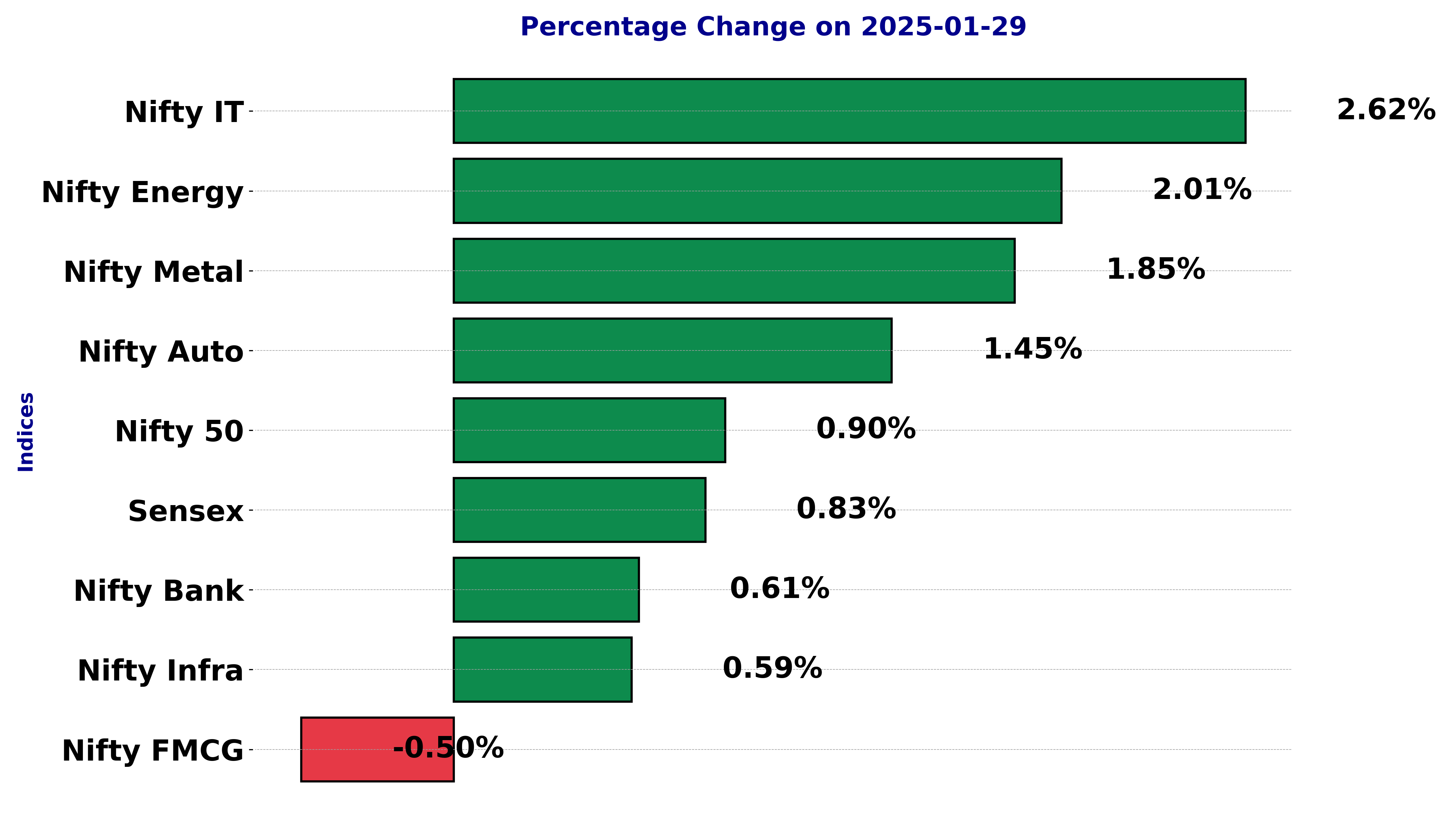

📊 Current Market Overview (India – 2025 Setup)

- Nifty & Sensex are in a long-term uptrend

- Earnings growth > GDP growth

- Strong government focus on Make in India & Defence

- FIIs selectively bullish on quality sectors

📌 Multibaggers usually appear before headlines, not after.

💡 Why Sector-Based Investing Works

Instead of guessing individual stocks, professional investors first identify:

👉 Stocks inside such sectors benefit from valuation re-rating + earnings growth.

🚀 Top 5 Multibagger Sectors to Watch in 2025

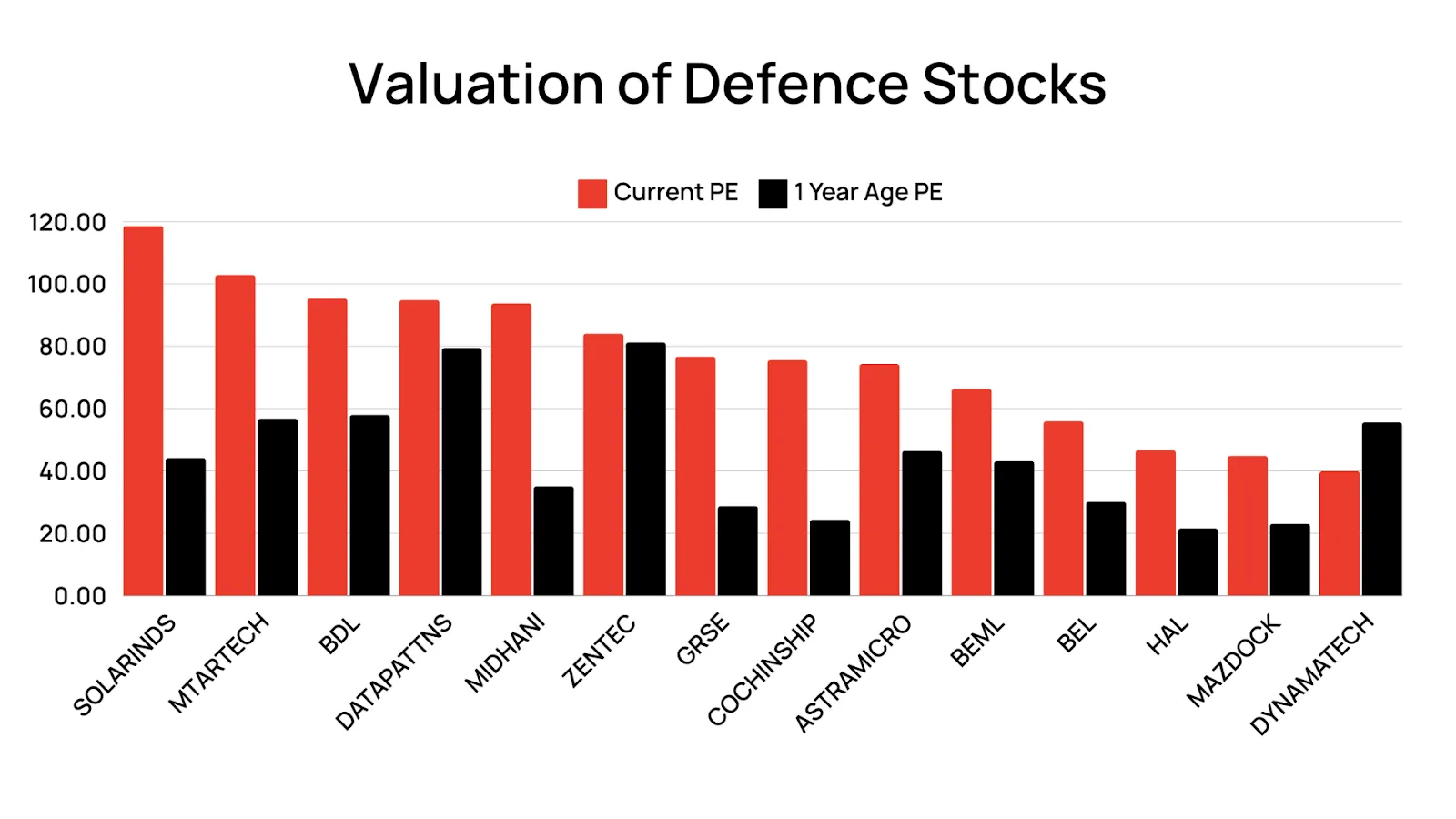

🔹 1. Defence & Aerospace (HIGH CONVICTION)

India is reducing defence imports and boosting indigenous manufacturing.

Why defence can create multibaggers:

- Record defence order books

- Long-term government visibility

- Export opportunities rising

📈 In my experience, defence stocks show slow starts but explosive long-term moves.

Key Themes:

🔹 2. Technology & Digital Transformation

Not just IT services—deep tech & AI-driven companies.

Growth drivers:

- AI adoption

- Cloud migration

- Cybersecurity demand

- Global digital spending recovery

⚠️ Avoid outdated low-margin IT plays.

🔹 3. Renewable Energy & EV Ecosystem

India’s push toward net-zero is creating long-term demand.

Opportunities include:

📌 Multibaggers will come from ancillary suppliers, not just big brands.

🔹 4. Manufacturing & Capital Goods

The China+1 strategy is benefiting Indian manufacturers.

Why this sector matters:

- Order books at all-time highs

- Operating leverage advantage

- Margin expansion phase

Look for companies with:

- Low debt

- High capacity utilization

🔹 5. Specialty Chemicals & Pharma APIs

India is becoming a global China alternative.

Multibagger triggers:

- Export-focused models

- Niche molecules

- Regulatory approvals

⚠️ High volatility but strong long-term payoff.

🔍 How to Identify a True Multibagger Stock

Use this simple checklist:

🔸 Financial Strength

- ROCE > 15%

- Low debt-to-equity

- Consistent earnings growth

🔸 Business Quality

- Monopoly or niche leadership

- Pricing power

- Long-term demand visibility

🔸 Valuation Comfort

- Avoid euphoric valuations

- Buy during consolidation phases

⚠️ Risk Management & Common Mistakes

Mistakes retail investors make:

- Buying after 300% rally

- Ignoring valuations

- No stop-loss or exit plan

📌 Multibaggers require patience, not overtrading.

Risk Disclaimer:

Stock market investments are subject to market risks. This content is for educational purposes only and not SEBI-registered advice.

🔗 Internal & External Links

Internal (Example):

- Long-Term Investing vs Trading (internal link)

- Beginner Guide to Stock Market (internal link)

External Authority:

- NSE India

- SEBI

- Investopedia

❓ FAQs – Best Multibagger Stocks 2025

Q1. Which sector can give multibagger returns in 2025?

Defence, renewable energy, and manufacturing sectors have strong policy and earnings visibility, making them top multibagger candidates.

Q2. Are defence stocks safe for long-term investors?

Yes, defence stocks have government-backed order visibility but require patience due to long execution cycles.

Q3. How long should I hold a multibagger stock?

Typically 3–7 years. Early exits often destroy multibagger potential.

Q4. Can beginners invest in multibagger stocks?

Yes, but focus on sector leaders, not cheap-looking stocks.

🏁 Final Conclusion + CTA

The best multibagger stocks for 2025 will come from strong sectors, not speculation. Defence, tech, renewables, and manufacturing offer structural growth opportunities for patient investors.

👉 Follow us for daily market insights

👉 Bookmark this guide for long-term investing

👉 Share with serious investors & traders

📌 Golden Rule:

Multibaggers are built with discipline, patience, and sector understanding—not tips.